Is it worth it? The risks and rewards of wave pool investment

Here’s what to expect if you are considering investing in a wave pool. We spell out the risks, rewards and explore whether there’s such a thing as a “sure bet.”

What does it take for a wave pool to get up and running? Dreams and daring help, sure. But mostly it’s money. Lots of it. This means major investors with Mariana Trench depth pockets or, as we discovered, lots of smaller investors pooling together. But once the money is secured, how long will it be before an investment is made back? Some folks are in it purely for financial return while others are focused instead on a lifestyle investment.

Initially, we posed the question, “If you invested, say, $1million in a $50million project. And it was successful, how long would it take you to see a return on your investment?” It sounded like a good question at the time with a solid metric and a clear goal. But we learned quickly that there are so many variables in play including the size of the pool, location, add-ons like hotels, private homes, lazy rivers (you get the idea), that it turned out to be the financial equivalent of “how-long-is-a-piece-of-string?”

This cute British colloquialism indicates that a subject cannot be given a finite measurement. You’d think that something as tangible as counting and numbers would be finite. But with wave pools it’s, uh, complicated. So we asked active developers and consultants (also briefly covered in this article) about their thoughts, as well as their experiences regarding the risks, returns, and opportunities presented by the emerging wave pool boom.

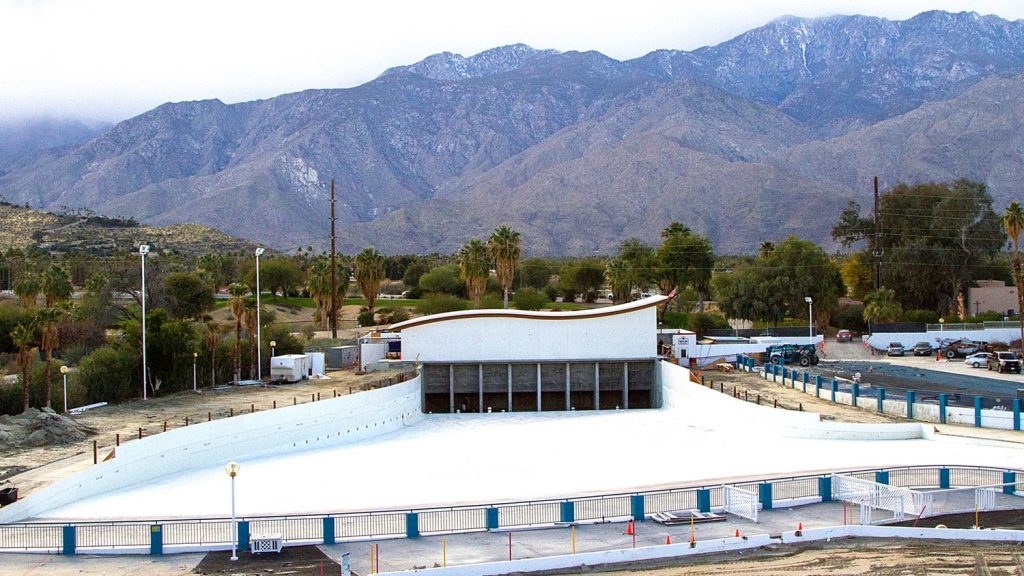

Do you think the Surf Ranch was a good investment at $33million to build? When it opened, Kelly’s dream charged between $30K and $50K to rent for the day, then boosted the prices by $20K about a year ago. If booked nearly every day, which by all reports it is, the pool could cover build costs in roughly two years.

HOW MUCH AND WHY SO MUCH?

The cost to license the technology and build a wave pool is pretty steep. The tech companies on the market today have told us their costs are between US$10-US$33 million for a wave engine and concrete pool. That pricing reflects a best-case scenario. Costs can run up quickly and could easily double depending on location. As an example, building a surf park in the middle of America is much less costly than building one in Hawaii, where concrete prices and labor are more expensive.

Doug Sheres from Beach Street Developments confirmed that there’s a very wide range of costs depending on pool technology, size, shape, program, geography, etc.

“In the US, for a smaller pool in a less expensive market, one can expect to spend a minimum of US$20 million on the combo’ of technology and construction/installation and some basic level of ticketing or other structures,” said Doug. “That’s for just the basic surfing and entrance experience.”

Doug added that these costs move up quickly, as larger pool projects with complete amenity offerings like a finished beach and the development of surrounding spaces can easily run US$50 to US$75 million.

“Once you start thinking about what goes around your pool – hardscape, beach, boardwalk, maintenance facilities, equipment facilities, food/beverage, entertainment, retail, parking, training, board rentals, etc., it all goes up.”

RAISING CAPITAL

Mark ‘Skip’ Taylor from Surf Park Management notes that people are recognizing wave pools as a credible area to invest in because they’re seeing previous successes – the work done by those dreamers who took the early moon shots.

“The stumbling block for so many projects is the financing and the raising of funds,” said Skip. “A number [of wave pools] in the early days were either funded through high net worth individuals or high net worth families.”

Skip shared insight about Bristol (The Wave) and Melbourne (Urbnsurf) where they took broader steps to secure the necessary financing for the project.

“I’m not privy to who or what, but I just know that they had syndicates of investors involved with both of those projects. And what I’m seeing right now is that now that projects are getting larger; financial groups and venture groups are becoming involved. My last call was for an hour with a capital group that does construction financing projects that are looking to step in at upwards of US$40 million of funding.”

Skip says the higher price tags has led to the formation over the last few years of venture funding companies that are being formed specifically for targeting the surf park space.

“There are also real estate investment funds (REIT’s) becoming involved, especially in the U.S., you know, people who’ve invested in top golf projects and other things that have become successful operations.”

Location is a huge consideration for potential projects. Many agree that Las Vegas would make the perfect place for a wave pool.

SMALLER INVESTORS

Skip estimates that in the early stages of a pool project the first round is going to raise US$3-to-US$5 million. And those usually come in via friends and family rounds. He says this initial push legitimizes a project to the point where they can sit at the table with the more sophisticated investors.

“A lot of people are now being sent investment opportunities in early-stage project opportunities, like a million bucks,” added Skip. “I mean, some are like US$50,000, US$100,000 and you know, they’re pulling small groups together to get themselves to be ready to talk to people with bigger dollars. Basically, there are numerous pathways to get these things funded and done.”

Skip confirmed that smaller, accredited investor programs are a tool that many of the surf parks are launching. This is good news for those who want to keep wave pool surfing anchored in surf culture as it helps “salted investors” have an entry point in a project rather than it solely the terrain of real estate developers.

“I would say the people in the surf world are passionate, and a lot of people are willing to put money in. It’s a passion investment.”

RETURNS

But what about those returns? Wave pools are a business, as are the ancillary restaurants and shops. Going by the numbers, there are north of 100 projects going on globally. Common sense dictates that not all of these are going to be successful. Some are going to become money pits, others may make a loss on the pool but make more through selling accommodations, while others may find their food outlets or shops will flop and the pool will be the cash cow.

It’s a wide and varied game. And from a bystander’s perspective, it’s intriguing. If you’ve got a ton of capital in the game, it’s terrifying.

“In terms of projected returns, some venues I’ve seen as short as four years, some as long as seven years and eight years,” said Skip, “And ideally after ten years, the REITs show that there’s a great return on this and they’re able to sell it to the next ownership group, right? So I think this model is going to be pretty prevalent in the surf pool world going forward.”

SAFE INVESTMENT?

Skip throws in a word of caution, stating it’s really important to know the group you’re investing in.

”Some parks are US$150 to US$200 million, and there are a lot of guys who have never raised any capital, never built anything in their lives, and never structured anything of scale. And if it’s the guy who has a dream to do it, who’s never done it before, and he’s asking you to throw money in, well I wouldn’t throw caution to the wind in that situation. But if you’ve got a group of guys who have a great team, a great plan, and a good reputation, that’s another story.”

Skip believes that investors need to be wary of people who are unrealistic about the financial model, those projecting low capital costs, and too high of income revenue model. As well as those projects which don’t have anyone validating, reviewing, or doing a proper feasibility study of the project.

“I think a lot of guys come with a little bit of a surfer-dude attitude to it who don’t have the background, and they don’t know what they don’t know, right? They can get way in over their heads without having the ability to progress things.”

Skip said that Surf Park Management is trying to focus the business on the right projects and the right teams that have the highest likelihood of success.

“You’re investing in the people part of that project. I think that would be, you know, the last piece of advice, is the track record of the people who are involved. It’s a super important piece.”

So, like any investment opportunity, if you are considering putting funds into a wave pool venture, do your homework. We all want a slice of the best waves, not ownership of a half-finished hole in the ground. But then again. About that exclusive email, I just received from a Nigerian Prince. The one promising great returns on the wave pool about to be built on the grounds of his private palace near Lagos – it’s tempting.

Related Coverage